The UK Financing Gap

The UK is one of the world’s leading economies, but is now at risk of falling behind. Watch Klaus Hommels and Sam Gyimah discuss the £1.5tn UK financing gap, and how building on the UK’s strong entrepreneurial ecosystem and existing strengths could triple GDP and secure digital sovereignty.

W A T C H T H E V I D E O :

The underlying strength of the UK economy

The UK’s wealth is based on a successful past. Enabled by privatisation, deregulation and financing for growth companies, the UK in the 1980s experienced significant value creation relative to the rest of Europe.

A strong financial and professional services sector, and the property market powered the UK economy ahead. And key sectors like banking, energy, healthcare, IT and telecommunications all led the way, financed mainly by traditional bank loans, backed by real assets, profits, or the rising stock market. A significant number of today’s FTSE 100 companies were built or scaled at this time.

With London as a global financial centre, world class universities, and flexible institutions, the UK economy has been a platform for innovation underpinned by an entrepreneurial can-do spirit.

A new generation of growth

The UK is now at risk of falling behind.

Since 2000, the UK has given away key sectors such as financial services, energy and ICT. The financial crisis brought the UK business model to a head which Brexit threw into sharp relief, while software, technology, and sustainable energy companies gained importance.

Hong Kong and Singapore have almost caught up with London as an attractive financial centre, with Dubai making great strides.

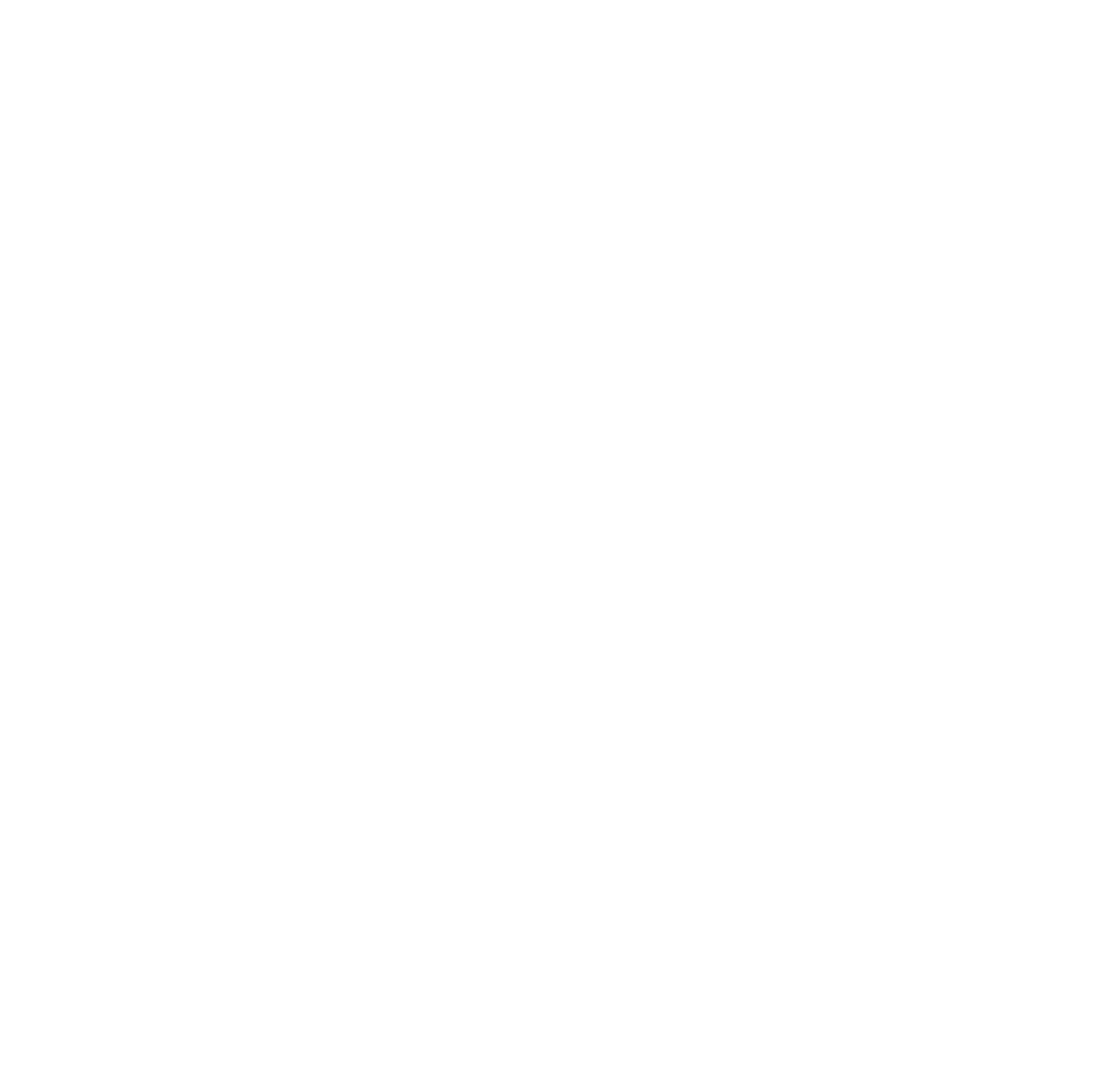

None of todays top ten UK companies was founded or truly scaled up in the last 20 years. This is very different to the dynamism of the US where seven of the ten were created in the last two decades.

Fast forward to a structural shift in growth financing.

Growth companies are fundamentally different today and financing is at much lower levels compared to GDP.

In the post war environment an average company would have taken decades to scale, but today’s innovators are seeing much more rapid growth through fast paced technological leaps. Scaling now happens within 5-10 years and contrary to past innovations their focus is now on technology with a high share of intangible assets which traditional banks are not allowed to finance anymore.

The UK financing gap

The next wave of economic growth cannot replicate the winning formula of the past. New sources of growth are required.

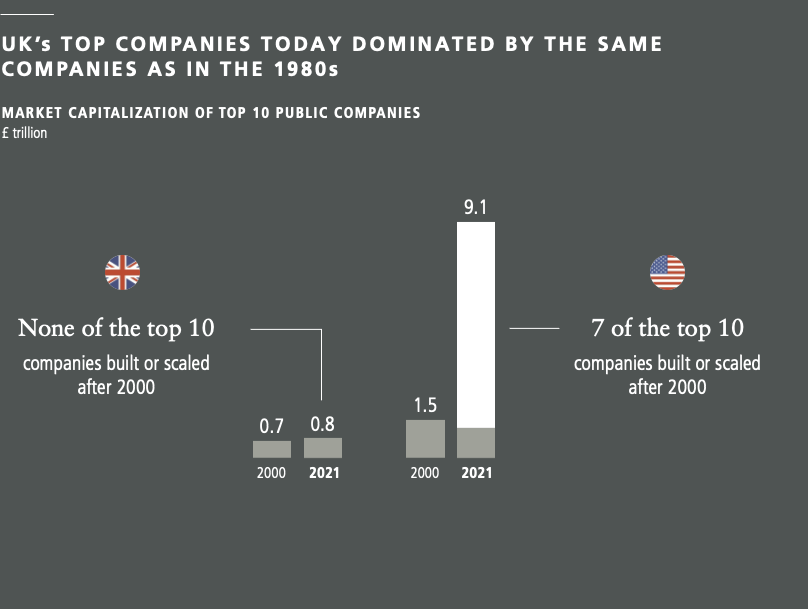

While the UK has the highest number of unicorns in Europe, there is a substantial financing gap that hinders the UK’s ability to commercialise first class innovation, scale the ventures, and build globally competitive businesses.

Consequently, the worlds most valuable private tech companies are mostly outside of the UK and Europe. And when UK unicorns need to raise financing to scale globally they almost always turn to foreign investors for investment. So UK and European superstars are largely US-governed with an increasing dependence on US infrastructure.

What’s needed going forward

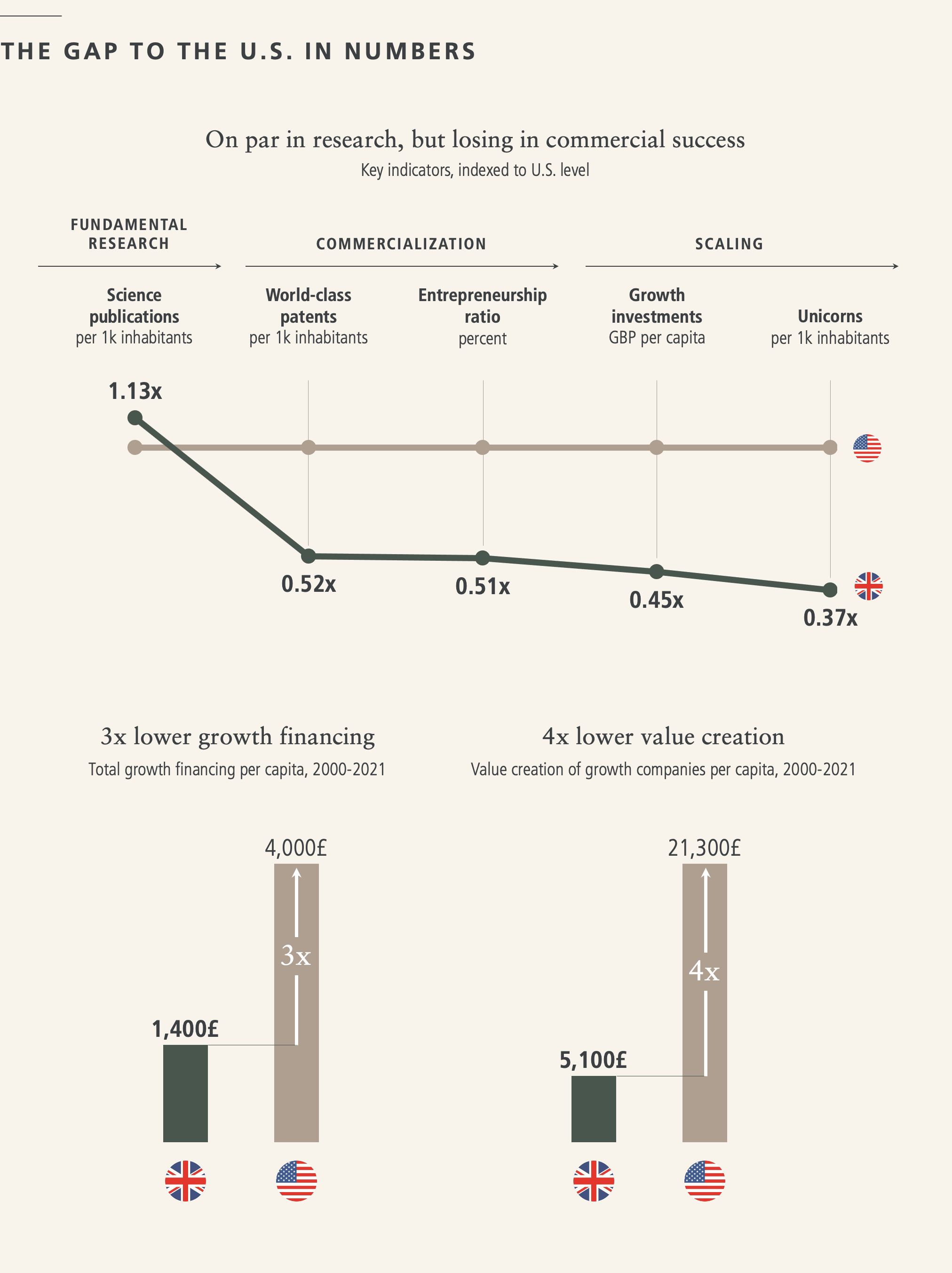

To secure a leadership position in new battleground industries and drive economic growth to 2-3%, significant growth financing will be required to scale scale up to 10,000 new growth companies and create value of £5-7tn.

For the UK this translates into a £1.5tn financing gap which equates to £75bn a year for the next twenty years. Unlocking new pools of capital at scale from pension funds and insurance companies to invest in new industries from energy to space, fintech, mobility, biotech, would ensure an economic transformation similar to that achieved in the 1980s that will shape future societies and ultimately benefit British pensioners. Four steps to achieving this goal:

Informing the broader public about the “growth financing” asset class

Shifting assets from public to private

Removing regulatory hurdles to pave the way for new asset allocation

Creating broad access, e.g. through lower investment thresholds or new models

Investment at these levels will secure the UKs strategic autonomy: headquartering critical industries in the UK and ensuring digital sovereignty in an increasingly uncertain world.