The European Financing Gap

While SMEs have always been the backbone of Europe’s prosperity, Europe is today facing challenges when it comes to financing their growth. Watch Klaus Hommels discuss how to secure Europe's strategic autonomy and its ability to profit from the fast-growing companies that will shape our future society.

W A T C H T H E V I D E O :

Europe’s wealth is based on a strong heritage

SMEs are the backbone of Europe’s prosperity. They account for almost two thirds of European jobs, and are profound drivers of economic growth and innovation.

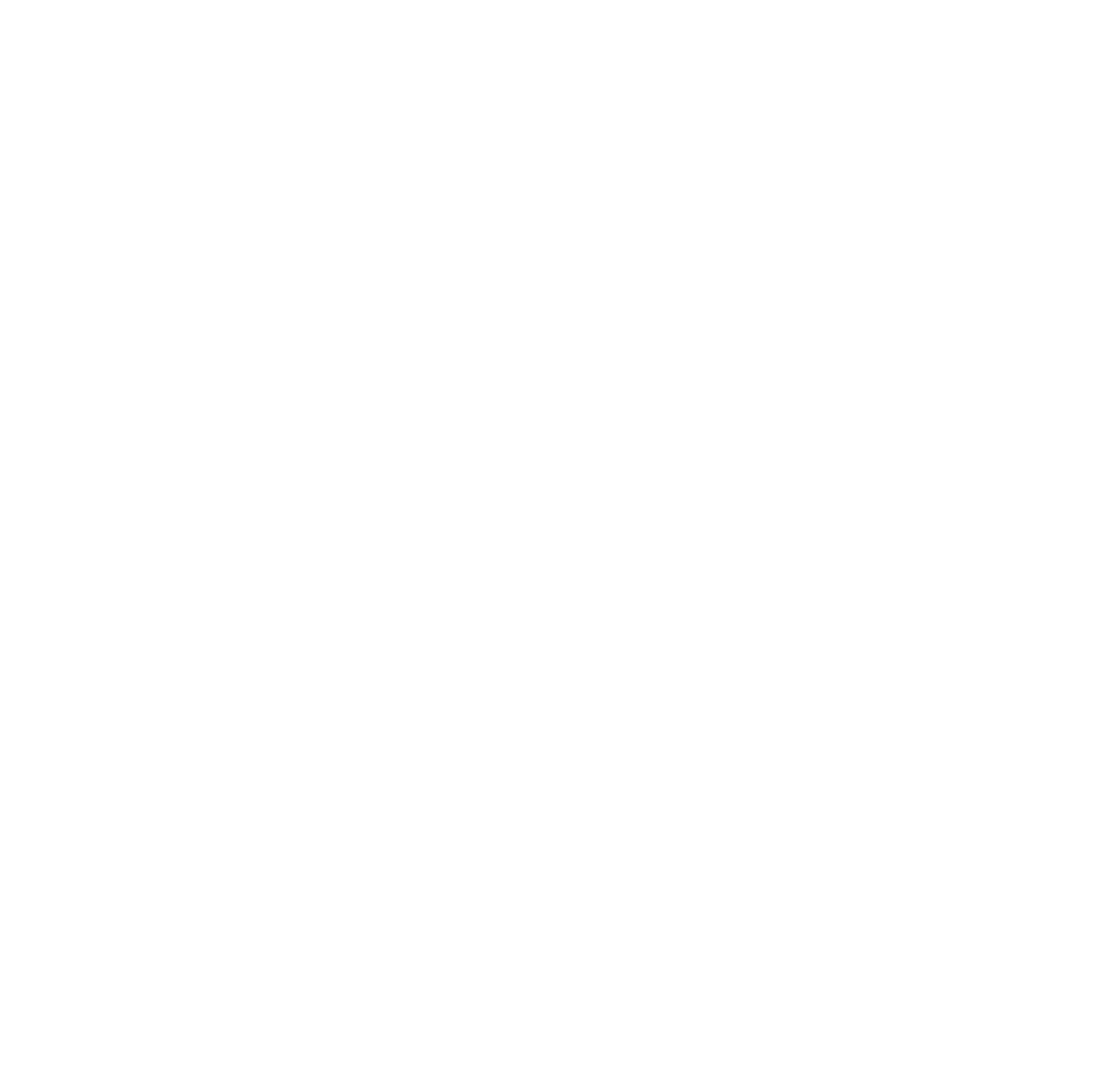

The foundation of this wealth was set in the 1950s-1960s, where technology innovation took place in core sectors like automotive, chemicals & machinery. Significant growth financing levels of up to 4% of GDP enabled this value creation and was mostly provided via banks. The majority of current DAX30 companies were built or scaled at that time.

A fundamental fast forward

Growth companies are fundamentally different today, and financing is at much lower levels compared to GDP.

While in the post-war environment an average company would have steadily scaled for decades, today’s innovators are seeing a much more rapid growth through fast-paced technology leaps. Scaling happens within 5–10 years and, contrary to past innovations, their focus is now on technology with high share of intangible assets, which banks are not allowed to finance anymore. Growth equity investors are required to fill this gap.

Overall financing today is up to 4x lower compared to GDP, and commercial lenders aren’t stepping up to the plate because the regulation framework doesn't allow them to finance these kinds of companies that are hyper-scaling but still loss-making. Their only source of financing is venture or growth capital.

The European financing gap

There is a substantial financing gap that doesn’t reflect Europe’s self-esteem in the global landscape, which will potentially give away Europe’s sovereignty in key fields of innovation.

While Europe has a strong talent-base and research capabilities through its world-class universities, it is often missing out on successfully commercialising and scaling innovation. As a consequence, the world’s most valuable private tech companies are mostly outside of Europe, and European superstars are largely US-governed. Europe is becoming increasingly dependent on US infrastructure.

What’s needed going forward

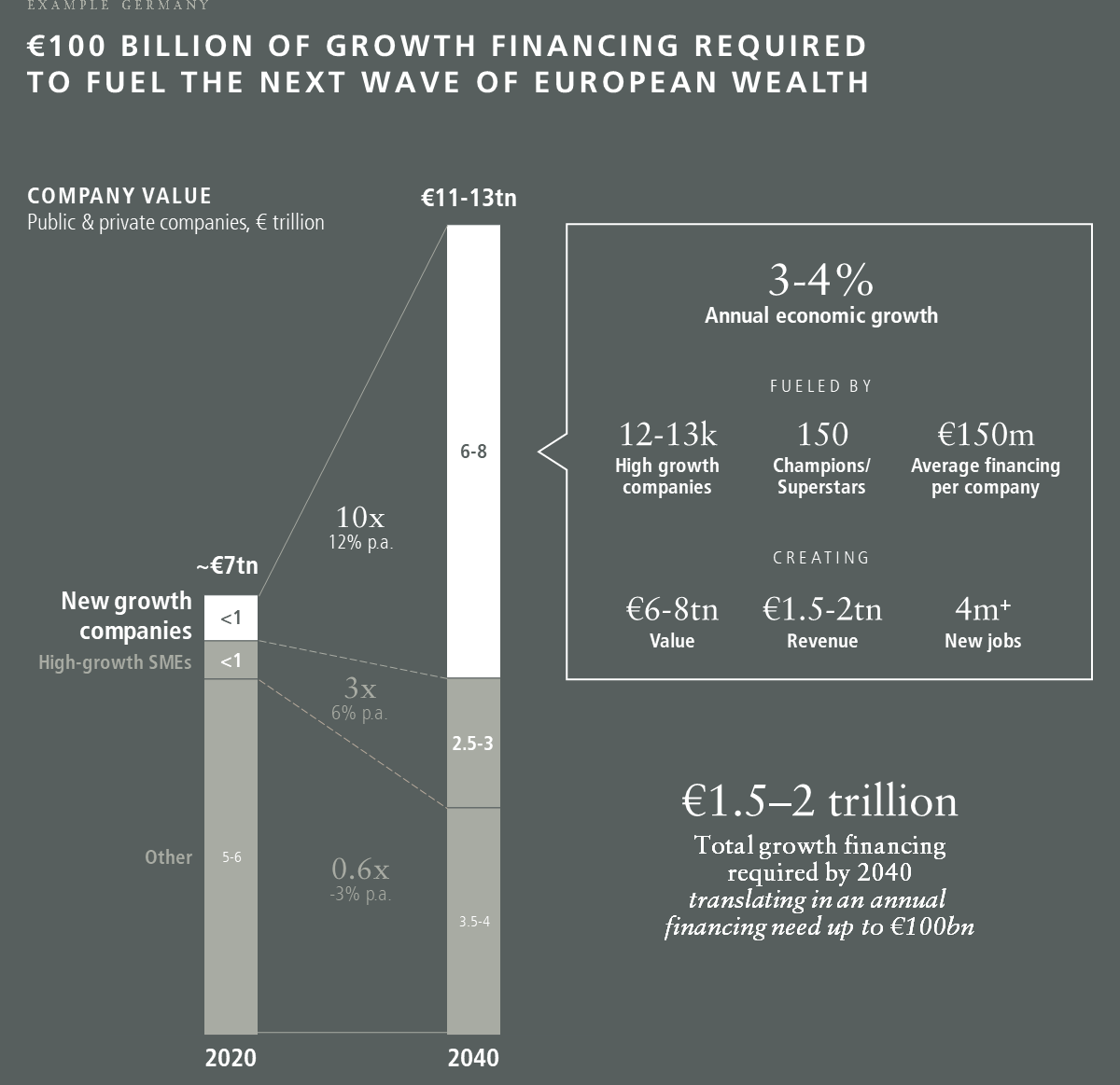

To keep Europe’s economic growth at a constant level and win future battleground sectors like energy, biotech, fintech, or mobility, significant growth financing will be required.

For Germany as an example, this translates into a €2 trillion financing gap, requiring an annual financing need of up to €100 billion every year. Europe has to find ways to enable large pools of money, such as pension funds or insurances, to invest in the private markets at a broader scale. There are 4 potential action fields to achieve this goal:

Informing the broader public about the “growth financing” asset class

Shifting assets from public to private

Removing regulatory hurdles to pave the way for new asset allocation

Creating broad access, e.g. through lower investment thresholds or new models

This will secure Europe's strategic autonomy and its ability to finance and profit from the fast-growing companies that will shape our future societies.